How to Avoid Late Entries, Bad Fills, and Missed Trade Ideas

Disclaimer: Trading involves significant financial risk and can result in substantial losses. Nothing in this article is financial advice. SageMaster provides tools that help you build strategies and work based on your own preferences. You are fully responsible for your trading decisions.

Why this blog is worth your time

If you’ve used SageMaster for a while, you’ve probably had moments like:

- “My Indicator sent a trade idea… why didn’t my trade enter?”

- “Why did SageMaster skip this trade idea?”

- “Why did the trade enter after price already reached TP and came back?”

In many cases, the answer is not that something is “broken.”

It usually comes down to four advanced settings in your Preset:

- Price Tolerance

- Time Tolerance

- TP Proximity

- Slippage

These settings are optional tools. You can run a strategy without them.

But depending on:

- The instrument you trade (XAUUSD, US30, NAS100, EURUSD, GBPJPY, etc.)

- The session (for example, high volatility during the New York session)

- Whether you’re trading intraday or swing

…these filters can make a big difference in how your entries are controlled.

By the end of this blog, you’ll understand:

- What each setting does in simple language

- How they work together inside your Preset

- How they can help you avoid late or low-quality entries, especially in volatile markets

How to answer common questions like:

“Can I turn both Price Tolerance and Slippage on?”

“Why did SageMaster skip this Gold trade idea?”

You’ll be able to stop guessing why a trade did or didn’t fire, and start intentionally controlling your entries — with a clear understanding of the trade-offs.

Quick glossary – same language we use in SageMaster

Let’s align on a few terms so everything stays clear.

Indicator Provider

The source that publishes Indicators.

They generate trade ideas.

They do not execute trades for you — your Preset + strategy decide that.

Indicator

A tool or logic (often from an Indicator Provider) that generates trade ideas.

Example trade idea:

“Buy XAUUSD at 2400.00, TP 2430.00, SL 2385.00.”

Trade Idea

The actual instruction coming from an Indicator:

- Entry price (or zone)

- TP (or multiple TP levels)

- SL

- Sometimes extra details like partial TPs

Preset

Your personal settings bundle attached to a strategy.

A Preset includes things like:

- Price Tolerance

- Time Tolerance

- TP Proximity

- Lot size / risk

- Other advanced options

When an Indicator sends a trade idea, your strategy uses your Preset to decide:

- “Do I accept this idea or ignore it?”

- “If I accept it, under what exact conditions do I send the order to the broker/exchange?”

Strategy

The engine that:

- Receives trade ideas from Indicators

- Applies your Preset rules

- Sends orders to your broker/exchange when conditions are met

TP (Take Profit)

The price where the trade is closed in profit.

SL (Stop Loss)

The price where the trade is closed to limit loss.

Pip / Point

A small unit of price movement.

- For many forex pairs like EURUSD, 1 pip = 0.0001 (e.g. 1.2000 → 1.2001).

- For instruments like XAUUSD, US30, NAS100, the step size and volatility are bigger, but the concept is the same: a unit of movement you can measure.

You can trade without these filters

Objectively:

- You can let every trade idea go straight to the market (subject only to connectivity and broker rules).

- This might suit:

- Very wide swing trades, where a few extra pips/points don’t matter much.

- Traders who want maximum participation in every idea.

- Users who actively monitor trades and accept more variability in entry price.

However, markets like:

- XAUUSD (Gold)

- US30

- NAS100

- Volatile pairs like GBPJPY

…can move dozens of pips/points in seconds, especially:

- During the New York session

- Around major news releases

- During intraday volatility spikes

In those moments, the difference between:

- The price at the time the trade idea was generated, and

- The price at the time the order hits the broker

…can be significant.

That’s where Price Tolerance, Time Tolerance, TP Proximity and Slippage become useful tools to shape your risk and entry behaviour.

They are not “good or bad” by themselves — they simply make your strategy more selective.

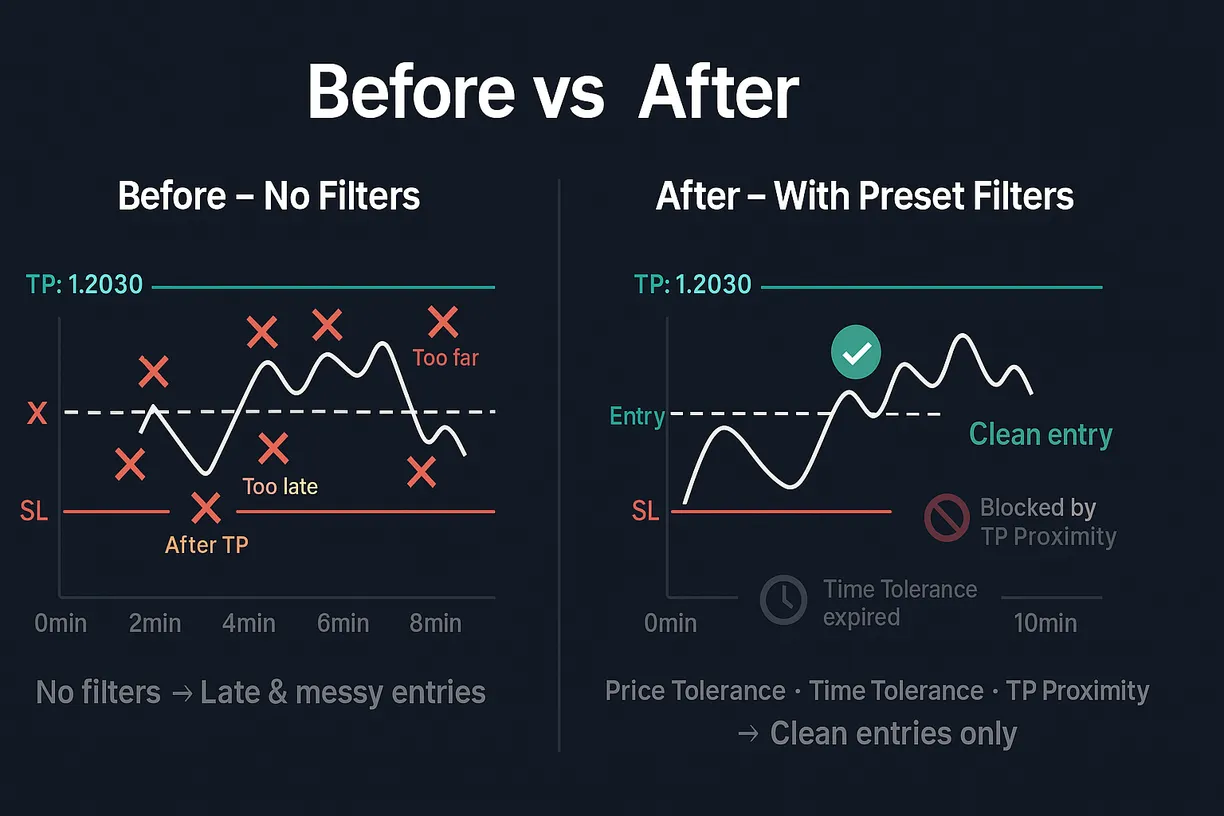

The real problem these settings are solving

Markets don’t move in slow, polite lines. A typical scenario looks like this:

- Your Indicator generates a trade idea.

- Your Preset and strategy start watching the market, waiting for your conditions.

- While they’re waiting:

- Price might move strongly towards TP.

- Price might hit TP1 or even full TP, then pull back.

- Price may then return to your entry zone and, at first glance, it looks “valid” again.

But logically, you might not want to enter anymore if:

- The move already completed most (or all) of its profit potential.

- The trade idea already hit TP once.

- The structure of the market has changed (especially on high-volatility symbols like XAUUSD, US30, NAS100).

SageMaster SFX gives you:

- Three layers of protection / control:

- Price Tolerance

- Time Tolerance

- TP Proximity

- And one execution helper:

- Slippage

So you can decide how strict or flexible you want to be with entries.

Slippage – execution “wiggle room” on the broker side

What is Slippage?

Slippage is not a trading strategy rule.

It is execution tolerance on the broker side.

It defines how many pips/points of difference you’re willing to accept between:

- The price your strategy requests, and

- The price the broker actually fills at, due to fast movement.

Example:

- Trade idea entry: 1.2000 (EURUSD)

- Slippage: 2 pips

If the broker can fill between 1.2000 and 1.2002, the order can be executed.

If only 1.2003+ is available, the broker may reject the order.

When would you turn Slippage ON?

Slippage can be useful when:

- The market is fast-moving or volatile, e.g.:

- Gold (XAUUSD) during New York session

- US30 / NAS100 during news

- You’re using market orders

- You prefer getting filled near your requested price instead of:

- Missing trades due to tiny price changes during execution

Without Slippage:

- You’re effectively telling the broker you only want to be filled at (or very close to) your requested price (trade idea entry price). In calm markets this might be fine, but in fast or volatile conditions (for example Gold or indices during New York session or news), the price can move before the broker executes the order. If the new price is outside that very small allowed range, the order may not be filled and you might see a rejection or requote, depending on the broker’s execution model.

When you allow some Slippage (a higher max deviation):

You’re telling the broker: “If you can fill me within X pips/points of the requested price, that’s okay.” This can reduce the chance of rejections in volatile periods, but the trade-off is that your actual fill price might be slightly worse than the original requested price when the market is moving quickly.

With Slippage:

You’re basically telling the broker:

“If you can fill me within X pips/points of the requested price, that’s okay.”

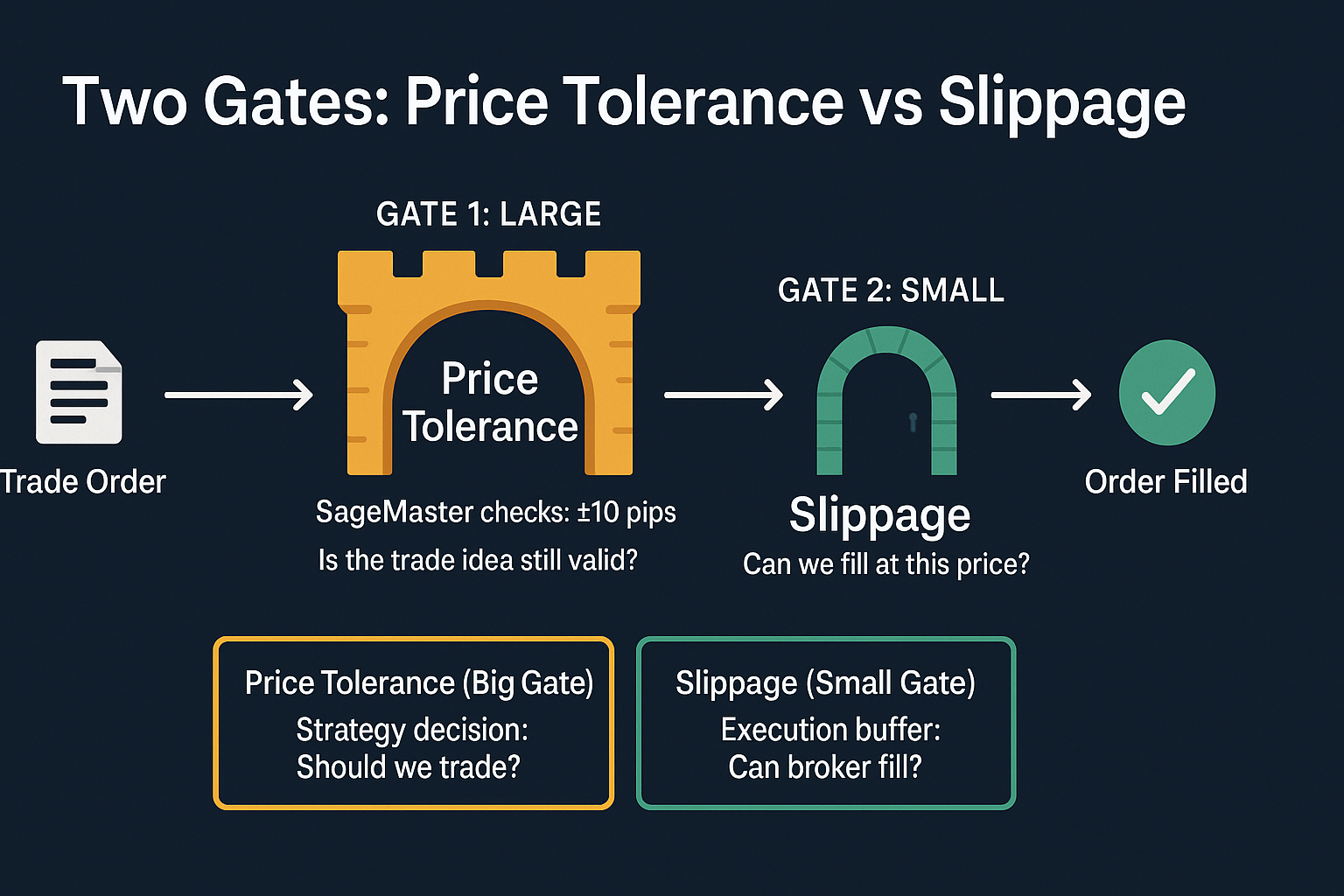

Does Slippage defeat the purpose of Price Tolerance?

No. They work at different stages and solve different problems.

Think of the flow like this:

Price Tolerance – on SageMaster SFX side

- Used by your Preset & strategy

- Decides if this trade idea is still valid at all.

- If price has moved too far from the original trade idea price, no order is sent.

Slippage – on broker side

- Used after SageMaster decides the trade is valid.

- Deals with tiny price changes during order execution (the order is already on its way).

- If the fill price is within your Slippage range → order can be filled.

- If not → broker rejects it.

So in plain language:

Slippage is your technical buffer:

“If the price is okay according to my rules, I’ll allow a small difference at the broker when the order is actually filled.”

Price Tolerance is your strategy guardrail:

“If the price is too far from what the Indicator suggested, I don’t want this trade at all.”

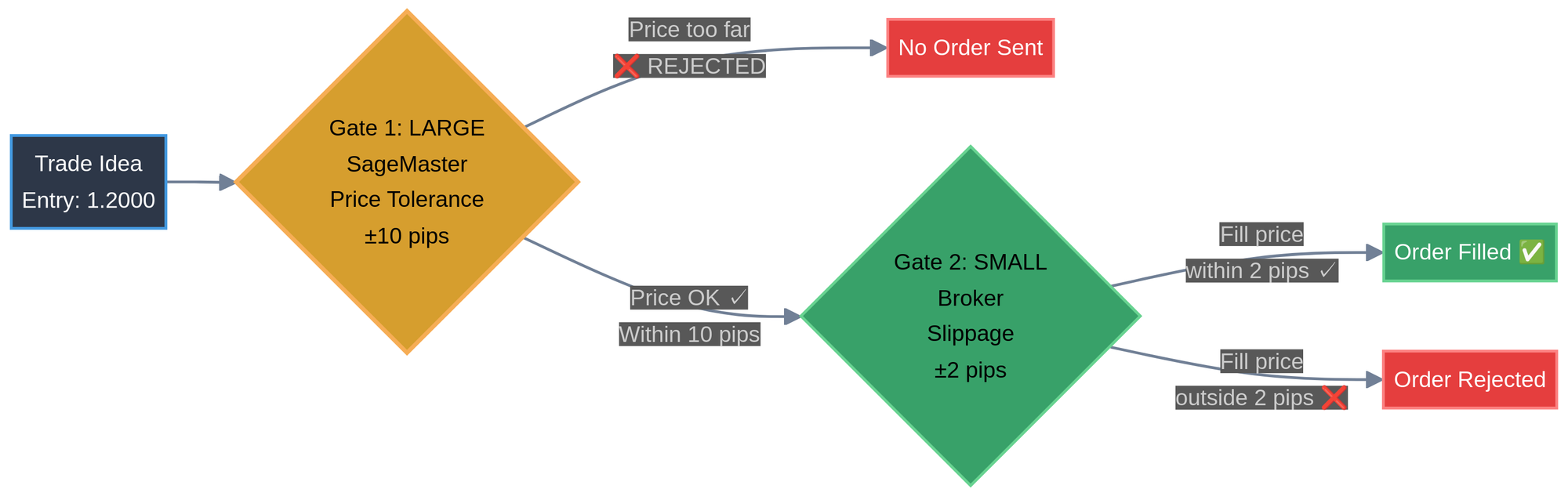

Can I use Slippage and Price Tolerance together?

Yes — and in many cases that’s a sensible setup.

Example:

- Price Tolerance: 10 pips

- Slippage: 2 pips

Flow:

- SageMaster checks the current price vs the trade idea:

- If price is more than 10 pips away →

🔴 Trade rejected at the strategy level. No order is sent.

- If price is more than 10 pips away →

- If price is within 10 pips:

- SageMaster sends the order with 2-pip Slippage.

- The broker tries to fill within those 2 pips.

- If it can’t → order is rejected at the broker level.

So:

- Price Tolerance decides whether you should trade.

- Slippage decides how much micro-movement you accept during execution.

Price Tolerance – how far from the trade idea you’ll still accept

What it is

Price Tolerance defines the maximum allowed price deviation from the trade idea entry for the trade to be considered valid.

- Checked on the SageMaster SFX side

- Set in pips (or % where available)

- If the current market price is outside this tolerance, your strategy does not enter

Example

- Trade idea: Buy EUR/USD at 1.2000

- Price Tolerance: 10 pips

Allowed execution zone: 1.1990 – 1.2010

If current price is:

- 1.2015 or 1.1980 → trade idea is considered no longer acceptable for that Preset.

- 1.2005 or 1.1994 → trade can still be executed (if other conditions are also met).

This prevents your Preset from “chasing” the market far away from what the Indicator originally suggested.

Intraday vs swing perspective

- For intraday or scalping on instruments like XAUUSD, US30, NAS100:

- Entry price matters a lot.

- Many traders prefer a tighter Price Tolerance.

- For swing trading with wider stops and TPs:

- Some traders allow a looser Price Tolerance or accept more flexibility.

Again, there is no “right” or “wrong” — it’s about expressing your style.

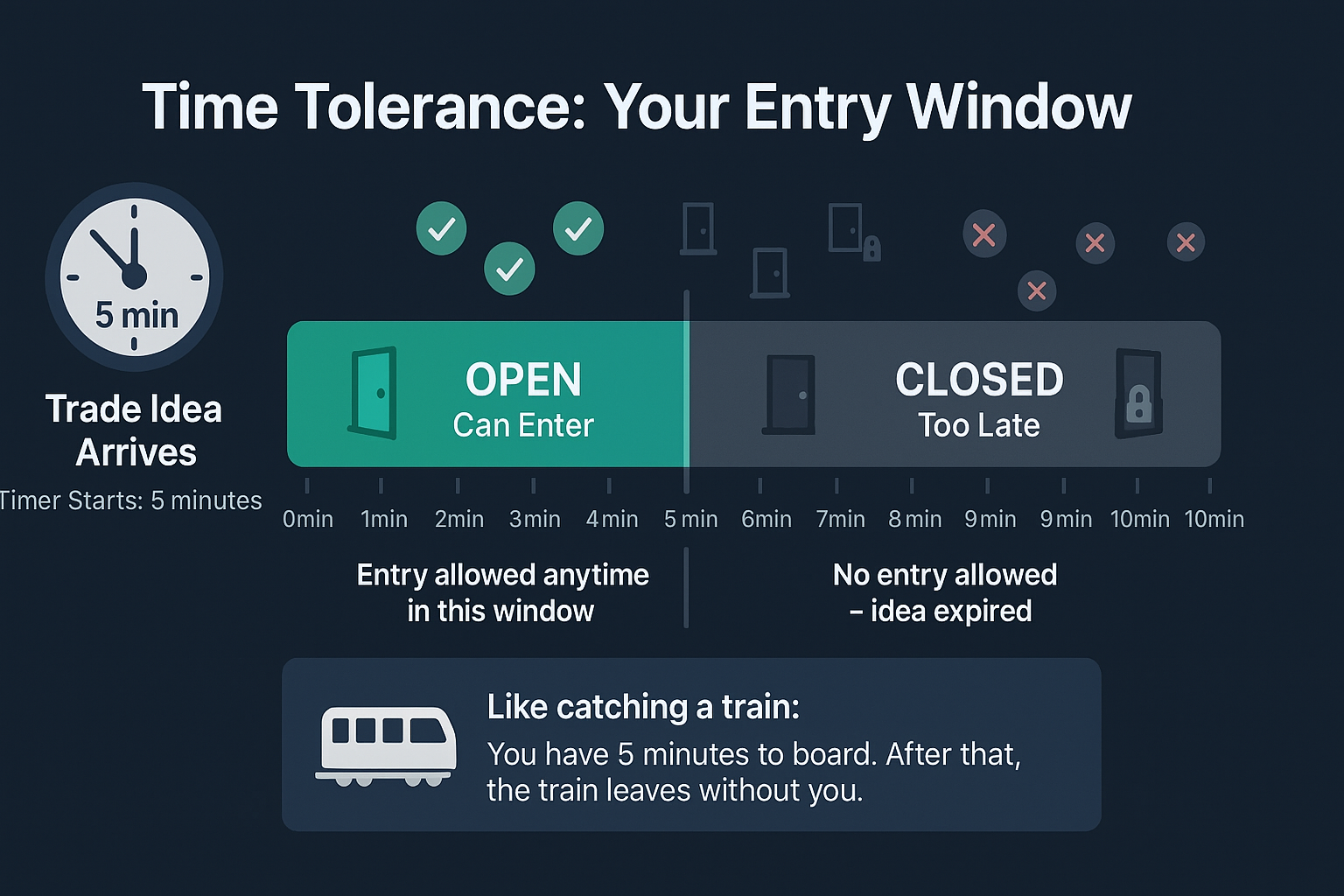

Time Tolerance – how long a trade idea stays valid

What it is

Time Tolerance defines how long your strategy should keep watching a trade idea before it is considered expired.

You’re basically answering:

“From the moment this trade idea arrives, how long am I willing to wait for my entry conditions to be met?”

- Set in seconds or minutes

- If the time passes and price never meets your rules, the trade idea is no longer used by that Preset

Example

- Time Tolerance: 5 minutes

Timeline:

- 10:00 – Indicator sends a trade idea

- 10:00–10:05 – Your strategy checks whether:

- Price is within your Price Tolerance

- TP Proximity (later section) is still valid

If by 10:05 price never entered your approved range:

- The trade idea expires for that Preset

- Your strategy stops watching it

- No late entry at 10:10 or 10:20

TP Proximity – protection against “already done” trades

The key problem it solves

Even when price and time look okay, the trade idea might have already played out.

Example:

- Indicator sends a trade idea:

- Buy at 1.2000

- TP at 1.2030 (30 pips)

- Your strategy waits (Price Tolerance & Time Tolerance active).

- Market moves:

- Price goes to 1.2030 → TP is hit.

- Then price comes back down to 1.2000 (your original entry zone).

- From a pure rule perspective:

- Current price vs entry → looks okay.

- Time Tolerance → might still be active.

But logically:

- The move to TP already happened.

- You’d be entering after the full move has already been completed once.

- Especially on volatile assets (Gold, indices), that can be very risky.

TP Proximity is designed to catch this situation.

What is TP Proximity?

TP Proximity measures how close price has already come to any TP level from the trade idea before your trade actually enters.

You define what “too close” means, using:

- Pips/points, or

- A percentage of the TP distance (depending on implementation)

If the market has already moved beyond your TP Proximity threshold towards TP, your strategy can:

- Stop monitoring that trade idea for entries, or

- Block new entries from that idea altogether

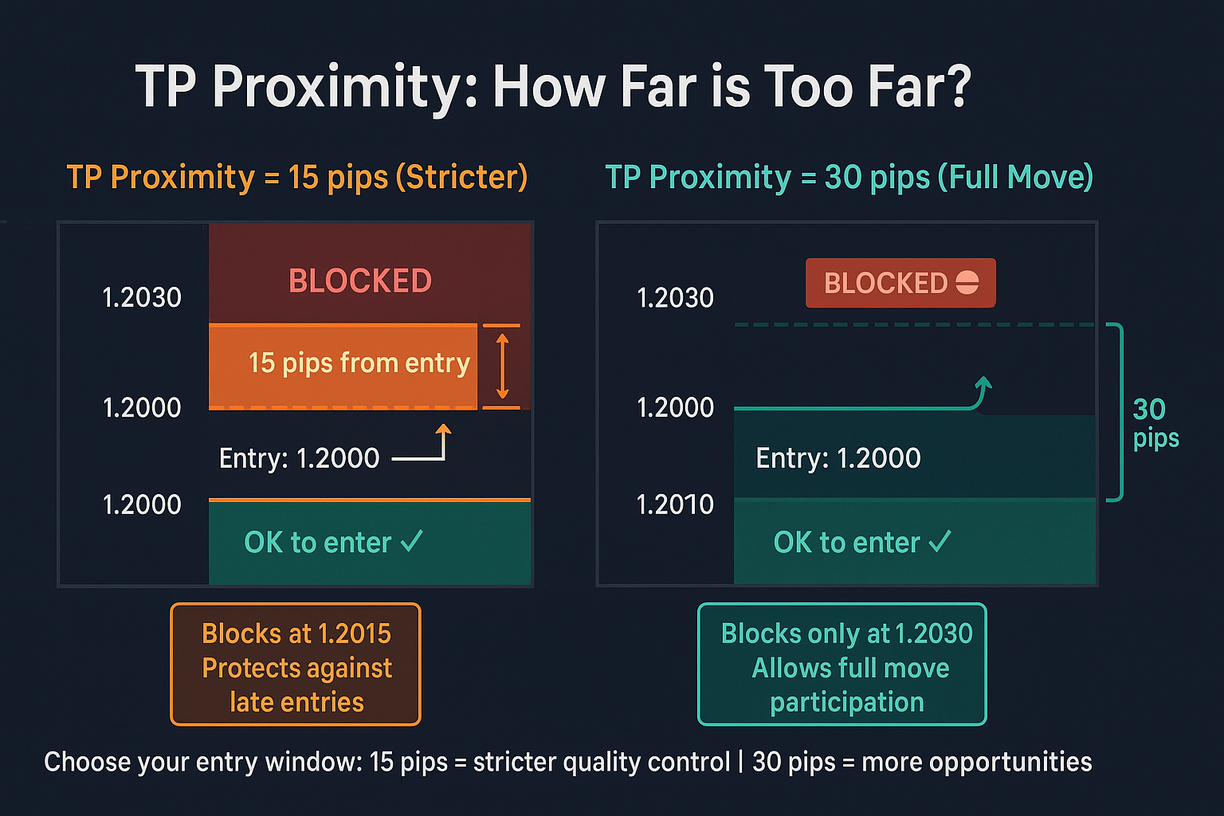

Example 1 – TP Proximity = 30 pips

Let’s use a 30-pip target:

- Entry: 1.2000

- TP: 1.2030

- SL: 1.1970

- TP Proximity: 30 pips

Scenario:

- Trade idea arrives.

- Price moves to 1.2020 → that’s +20 pips from entry.

- Price then returns to around 1.2000.

Question:

- Has price reached your TP Proximity of 30 pips?

→ No, it only reached 20 pips.

Result:

- TP Proximity does not block this trade yet.

- If Price Tolerance and Time Tolerance are still okay, your strategy may still enter on the pullback.

Meaning:

“As long as the market hasn’t reached my full 30-pip potential yet, I’m still okay entering if price returns to entry.”

Example 2 – TP Proximity = 15 pips (stricter)

Same 30-pip target:

- Entry: 1.2000

- TP: 1.2030

- TP Proximity: 15 pips

Scenario:

- Price moves from 1.2000 to 1.2015 (+15 pips) or higher.

- That instantly hits your 15-pip TP Proximity threshold.

- When price later comes back to 1.2000:

- From a pure price/time perspective: it looks okay.

- From a TP Proximity perspective: the move already did 15+ pips towards TP.

Result:

- Your strategy stops monitoring this trade idea for new entries.

- No entry will be triggered from this idea, even if price re-enters your Price Tolerance range.

Meaning:

“If half of the move has already happened without me, I’m not interested anymore.”

How this connects to the 30-pip logic

You mentioned:

If I’m targeting 30 pips, it might not make sense to set TP Proximity at 15 pips. I’d rather set it to 30 pips so that once the full 30 pips has been reached, I definitely won’t enter when price comes back.

That’s a valid and clear use case:

- TP Proximity = 30 pips

→ “Don’t let me enter if the full move already happened.” - TP Proximity = 15 pips

→ “Don’t let me enter if half the move already happened.”

There is no universal “right” value; it depends on:

- How aggressive or conservative your style is.

- How okay you are with joining a move that’s already partly done, especially on fast pairs or symbols like XAUUSD, US30, NAS100.

How all four work together inside your Preset

Let’s walk through the full pipeline from Indicator to broker.

- Indicator generates a trade idea

Example: Buy EUR/USD at 1.2000, TP 1.2030, SL 1.1970. - Your Preset (attached to your strategy) kicks in

It applies:- Price Tolerance

- Time Tolerance

- TP Proximity

- Position sizing & other advanced rules

- Time Tolerance starts

- From the moment the trade idea is received, the Time Tolerance countdown begins (e.g., 5 minutes).

- While Time Tolerance is active:

- Strategy checks if the current market price is within Price Tolerance.

- Strategy checks if the move toward TP is still acceptable (within TP Proximity).

- If all Preset checks are OK:

- Strategy sends an order to the broker/exchange.

- Broker applies Slippage (if enabled):

- Broker tries to fill within your Slippage range.

- If the broker can’t → no fill.

- If Time Tolerance expires first:

- Strategy stops watching this trade idea for that Preset.

A simple analogy for beginners

Think of it like catching a train:

- Indicator:

Someone tells you, “Train A goes to your destination.” (Trade idea) - Preset & Strategy:

Your personal rules for deciding if you should actually board that train.

Slippage:

The small push and shuffle as you step inside.

You accept a tiny difference in where you stand, but not too much.

TP Proximity:

“If this train already went almost all the way to the final stop and came back, I’m not getting on. That trip is basically over.”

Time Tolerance:

“I’ll only wait at the platform for X minutes. If it doesn’t feel right by then, I’ll leave.”

Price Tolerance:

“If the train is too far from the platform or not in the right position, I’m not getting on.”

Practical starting tips

To keep this practical and objective, here’s a safe mindset:

- Start with reasonable Price Tolerance

- Enough room for normal market noise.

- Not so large that you’re entering at completely different prices from the trade idea.

- Set Time Tolerance based on your style

- Shorter for scalping / fast intraday strategies.

- Longer, but still finite for swing trades.

- Choose a TP Proximity rule that matches your logic

- If your TP is 30 pips and you only want to avoid very late entries:

- Set TP Proximity closer to 30 pips.

- If you don’t like joining halfway into the move:

- Consider something like 40–60% of your typical TP distance.

- If your TP is 30 pips and you only want to avoid very late entries:

- Use Slippage as a small buffer, not a big one

- It’s a micro-parameter to reduce rejected orders, not a replacement for Price Tolerance.

- Always test with demo or small size first

- Watch how many trade ideas are skipped.

- Check whether the behaviour matches what you intended.

Trade-offs and moderation

Being fully honest:

- There will be times when:

- A trade idea is skipped due to Price Tolerance.

- It expires due to Time Tolerance.

- It is blocked due to TP Proximity.

- Or the broker rejects it due to Slippage being tight.

…and price still moves in the direction of the original idea.

That’s not a bug. That’s your Preset doing exactly what you told it to do:

“I prefer control and alignment over catching every possible move.”

On the other hand:

- If you disable most filters, you’ll catch more trades…

- …but also accept more late, far or already-played-out entries.

There is no way to have:

- Perfect entries

- Zero missed trades

- And zero risk

All at once.

So the goal is moderation, based on:

- The type of Indicator Provider you follow (intraday vs swing)

- The instruments you trade (XAUUSD, US30, NAS100, FX)

- Your personal risk and patience level

SageMaster doesn’t decide what’s “right.”

It just gives you the tools to define your own rules clearly.

FAQ – Common questions you might have

1. Can I turn on both Price Tolerance and Slippage?

Yes.

They do different jobs:

- Price Tolerance decides if the trade idea is acceptable at all (strategy layer).

- Slippage allows for tiny execution differences at the broker (execution layer).

Most users will want:

- A clear boundary (Price Tolerance) and

- A small technical buffer (Slippage).

2. Should Slippage be smaller than Price Tolerance?

In almost all cases, yes.

Slippage is your tiny buffer:

“If price moves 1–2 pips/points at the moment of execution, that’s okay.”

Price Tolerance is your big rule:

“If the price is more than X pips/points away from the idea, don’t trade.”

3. If I care a lot about precise entries, should I set Slippage to 0?

You can, but be aware:

- With Slippage = 0, your orders are more likely to be rejected in volatile markets, even if the trade idea is valid.

- Many traders prefer a small Slippage (e.g. a couple of pips or reasonable ticks) to balance execution reliability and precision.

4. Can I use TP Proximity with multiple TP levels (TP1, TP2, TP3)?

Yes. In general:

- TP Proximity checks how close price has come to any TP level in the trade idea.

- If price has already moved beyond your proximity threshold toward a TP (for example TP1), your strategy may stop watching that idea for new entries.

This helps avoid entering after one of the targets has already been reached.

5. What happens if TP Proximity is disabled?

If TP Proximity is off:

- Your entries will be controlled mainly by:

- Price Tolerance

- Time Tolerance

Your strategy won’t check whether the trade idea already came very close to TP before entering.

In some cases, that means entries can still happen after a big part of the move, or even after TP was touched and price pulled back.

6. How do I choose a good TP Proximity value?

There is no universal “correct” value, but:

- Think in terms of your typical TP distance.

Example: if your usual TP is 30 pips:

- TP Proximity ~15 pips → block entries when half the move already happened.

- TP Proximity ~30 pips → block entries only after the full 30-pip move happened once.

Ask yourself:

“At what point do I feel the move is too mature for me to enter?”

Start with a value that feels logical, then test and adjust.

7. Does using these settings guarantee better results?

No setting can guarantee:

- Profits

- Or prevent losses

What these settings do is:

- Help you filter trades that don’t match your rules.

- Prevent some clearly late or low-quality entries.

- Give you more control over how trade ideas sent to your brokers/exchanges.

Markets are unpredictable. Even a perfectly filtered entry can still be a loss. These tools are designed to maintain quality, not guarantee a specific outcome.

8. Why did SageMaster skip a trade idea I thought should be taken?

Most often, it’s one of these:

- Time Tolerance expired before the price entered your range.

- Price Tolerance was exceeded, even briefly.

- TP Proximity detected that the move towards TP already went past your limit.

- Slippage was too tight and the broker couldn’t fill at your requested price.

Whenever a trade idea is skipped, check:

- Your Preset settings

- The price action around the time of the trade idea

- Any logs/notifications (if available) explaining which condition failed

9. Does my broker account type affect how well these settings work?

Yes. Your account type and broker conditions play a big role in how your entries behave, especially for intraday strategies.

Key factors:

- Execution model & speed – How fast the broker can fill your orders (and how they handle slippage / requotes).

- Spread – The difference between bid and ask; this is a direct cost on every trade.

- Commission – Some accounts charge lower spreads but add a separate commission.

Your Preset settings (Price Tolerance, Time Tolerance, TP Proximity, Slippage) work the same logically, but the quality of the fill you get depends heavily on the account you connect.

10. What type of account is generally better for SGM / SageMaster SFX strategies?

In general, for SGM and SageMaster SFX strategies—especially those trading Gold (XAUUSD), indices (US30, NAS100) and active forex pairs—accounts with:

- Low spread or 0 spread, and

- Fast, reliable execution

tend to be more suitable.

That’s why ECN-style accounts with low or near-zero spread are considered optimal in many cases:

- Tighter spreads make it easier for:

- Small TPs, tighter SLs, and trailing logic to make sense.

- Execution filters (Price Tolerance, TP Proximity) to work as intended.

- You usually pay a transparent commission instead of hidden costs inside a wide spread to your broker.

This doesn’t mean other account types are “bad”; it just means that high spread + slow execution can make your strategies feel less responsive and more expensive per trade.

Important: SageMaster does not create or control your broker’s execution conditions. You are responsible for choosing a broker and account type that match your risk profile and local regulations.

11. How do high spreads affect my entries and results?

High spreads can affect you in several ways:

- Worse effective entry

Even if your idea is correct, a wide spread means you start the trade further from break-even. - More friction for tight setups

For small TP distances or tight SLs (common in intraday or Gold strategies), a wide spread can:- Eat up a large percentage of the expected move.

- Make TP/SL and breakeven logic less efficient.

- Interaction with your filters

In extreme volatility with wide spreads:- Price may appear to “jump” more.

- Your Price Tolerance might be hit more often.

- TP Proximity may trigger earlier than you’d expect if the market spikes.

For this reason, if you’re using tighter targets or more active strategies, low-spread or ECN-style accounts usually align better with how these execution filters are designed.

12. Is a “0 spread” account always better? Does that mean there’s no cost?

Not automatically, and no—there is still a cost.

“0 spread” or “raw spread” accounts typically mean:

- Spreads are very low most of the time (sometimes near 0), but

- You pay a fixed commission per lot or per trade to your broker.

Things to keep in mind:

- During news or high volatility, spreads can still widen, even on “0 spread” accounts.

- You should always look at the total trading cost:

- Spread + commission + swaps (if you hold overnight).

From SGM / SageMaster SFX’s perspective, these accounts are often more predictable for execution logic, because:

- The market price you see is closer to the “real” underlying feed.

- Your filters (Price Tolerance, TP Proximity) are interacting with cleaner pricing.

13. Does my account type change how Slippage behaves?

It can.

- On some Instant Execution accounts:

- The “maximum deviation” (Slippage) parameter is used as a hard limit.

- If price moves beyond that deviation, you may see rejections or requotes.

- On many Market Execution / ECN accounts:

- The deviation parameter is often ignored, and you’re filled at the current market price.

- You can still experience slippage (positive or negative), but you can’t strictly cap it just with the Slippage value.

That’s why it’s important to understand your broker’s execution type and not rely solely on Slippage as your protection.

Your main control over which trades you accept and where should still come from your Price Tolerance, Time Tolerance, and TP Proximity settings inside SageMaster.